I’ve often said that, based on my own experience, collecting art seems to follow the Pareto Principle, or what is known as the 80/20 rule. Many natural phenonemon have been observed to follow this common rule of thumb, which, when applied to art collecting, can be stated as folllows: “roughly 80% of your profit when selling your collection will come from 20% of your collection.” Put another way, this means that 80% of the value in the art you are buying today (and assuming you keep it for an average 10-20 years (the usual “generational turn”) resides in 20% of the art—an outcome that will become clear only when the dust has settled, and you realize that 80% of what you own is selling for the same or less than you paid for it—and any return on your investment (whether that’s your goal, or not) has come from the remaining 20% of your collection.

If you have a decent “eye,” and haven’t been totally immune from common sense collecting strategies, that 20% minority will more than make up for the losses you’ll bear on the 80% majority of what you own. Too bad we don’t know WHICH artworks will end up in that 20% pile when we buy them! Ah, if only we had those crystal balls, right?

The 80/20 Rule in Action

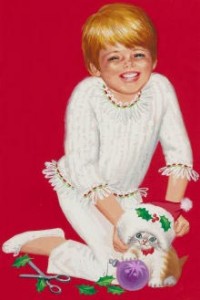

As only one example of the 80/20 rule, consider the published realized prices for illustration art from the Heritage Auction sales of art from the collection of Charles Martignette, which results can be accessed in Heritage Auction archives at www.ha.com, and spanned five sales across five years, 2009-2013. His collection included comic art and western art, but for the purposes of this exercise, I am zeroing in on the illo art, carrying the designation “estate of Charles Martignette.” Checking the archives, we find a total of 4180 sold paintings, at prices ranging from $17.00 to $286,800 (including buyer’s premium). Roughly 10%, or only 400 paintings sold for $10,001 to more than $100,000 The remainder, or about 3780 pieces, sold for less than $10,000, with the largest number of paintings, roughly half the total sold (2041) selling for between $1000 and $10,000. So, while the majority of the collection was weighted towards the mid-range in values, based on today’s market (the $1000 to $10,000 category, it is undeniably true that a minority of pieces essentially carried the value of all the offerings as a whole. And, while the top piece, a “pin-up,” sold for quite a hefty sum, it would be an unfair conclusion to draw from this kind of sale that all such paintings did equally well. In fact, the next highest painting, by the same artist and also a pin-up, went for 30% less. However, it IS true that 17 of the top 20 paintings were pin-ups. And if you simply considered the extremes, you would see the same pattern, demonstrating the 80/20 rule: 114 artworks sold for under $100, and 20 sold for over $100,000.

[note: because it would simply be too time consuming to do otherwise, the calculations of selling prices by price category are rough estimates, calculated by multiplying the midpoint of each price range times the number of paintings sold in that category, for example: 114 paintings selling between $1 and $100 = 114 x $50 or $5700, and 20 paintings ranging from 100,000 to the maximum $286,000= 20 paintings x $190,000 = $3,800,200]

Why is this Instructive/Important?

There are some outcomes that you and I could probably predict, based on what we know about the factors that affect art prices (and see my previous posts on art hierarchies): that (all things being equal) signed art will sell for more than unsigned art; larger art will sell for more than smaller art; magazine illustrations will sell for more than greeting card art; that sort of thing. But could I have predicted the spread of prices here? Or that a cute little “girl with kitty” would sell for five times less than an unsigned “Railroad Girl” prelim with condition issues? NO. And who knows what Martignette actually paid for these? Doesn’t that matter? Not Really.

The longer you collect, the more you learn about other collectors, and the field in general. Over the course of a generation or two, you follow all the significant auctions in your field; you meet other collectors and learn their tastes and collecting tactics; you talk to artists and gallerists and dealers and hear the gossip. Based on all this information you can extrapolate. Would Charles have paid $200,000 for a pin-up, let alone any piece of art in his collection? Doubtful. Would he have paid $20 on average for all the Norcross greeting card illustrations? Possible. Or a little more.

Some outcomes that may seem reasonable on the surface—or which appear to be “logical” sales results based on other offerings in a public sale—can mean much more to those who are privy to “insider” information, the sort of information that comes from being involved in the prior sale of the art in question, so that “profits” or “losses” can actually be known.

Such is the case with at least two paintings from the Martignette collection.

From the sale in 2012 comes “Mantee” by British artist Richard Clifton-Dey. I was agent for the sale of all art from this estate, representing his widow, and sold this painting to Charles Martignette on eBay in 2009 for $260. This was not the only purchase Charles made from me over the years, but he did like buying “on the cheap” so this win on eBay was one of the rare times when he ended up paying more than anyone else, without being able to complain about my pricing (!)

Because most of the Clifton-Dey cover art sold between $225-$350, and this piece DID have a bare-breasted woman in the background (and thus appeal to collectors who want pin-ups), someone *might* predict this piece to sell for more than was paid for it, in 2009. But it didn’t. In fact, it sold for 30% less.

The second example is a “pulp” cover by Leo Morey, which sold for $10,755 in the Heritage Oct. 2009 sale.

This painting previously sold at a Christies auction in 1999, as I recall, for $8500 + premium, which I believe was 15% at the time—making the cost $9775. I remember this painting very clearly because I was underbidder for it (!) and learned later on that Martignette was the winner. (note: I never disclosed this to him while he was alive). Ok: so based on the $, you might conclude there was a little profit for the estate, after 10 years. NOT SO! According to a simple savings calculator (such as www.bankrate.com) and using a modest 5% rate of return annually, starting with $9775 in 1999, by 2009 you would have accrued $15,922. in savings . . . without much risk. So, again, a 30% loss, and how what looks “on the surface” to be a gain when looking at art sales results can be terribly misleading. Collectors often make this mistake, not factoring in the time value of money, or the outcomes had the same amount of money been put into other, and more liquid, investments.

All of which points to the fact that art is among the most speculative of ventures, and that, bottom line:

It is impossible to predict the directions of the art market.

If it were possible, art investment funds would be hugely successful (they’re not), wealthy individuals would be pouring their money into fine art as investments (they’re no—which is a good topic for a future post), and I (for one) might have given Charles Martignette a helluva lot of competition buying pin-up art 20 years ago, back when he seemingly was cornering the market on the stuff. But it doesn’t matter.

What matters is that NO MATTER WHAT YOU BUY, because of that 80/20 Rule, you will end up surprised by what, ultimately, become the most valuable items in your collection! Charles wasn’t prescient either, or being driven simply by the idea that pin-ups would end up being the most valuable paintings he owned. If that were his motive, he (obviously) wouldn’t have bought thousands of “other than pin-up” art. He just loved the stuff, and bought it all….and time and the market does the rest.